+44 203 551 1514

info@aurnex.com

Accounting Services- VAT &

Bookkeeping

Don't let VAT & Bookkeeping tasks bog you down. Partner with Aurnex and experience the difference. Streamline your operations, boost efficiency, and take your business to new heights with Aurnex by your side.

What sets Aurnex’s Accounting Services Apart?

Our team’s extensive experience and diverse expertise in Accounting services sets us apart. Whether it’s routine compliance tasks or high-stakes challenges, our professionals bring a wealth of knowledge and insights to deliver unparalleled value to your business.

Why Choose Aurnex’s Accounting Services?

We understand the importance of seamless integration with your existing systems. That’s why we utilize the same bookkeeping software as your organization, ensuring a smooth transition and uninterrupted service delivery. With our comprehensive Accounting Services, you can trust us to manage your day-to-day transactions efficiently and effectively.

Have Questions about Aurnex Accounting Services?- Check our FAQs here.

What it includes?

Accounting

Sub Services

Sales & Purchases

Bank Categorization

Bank Reconciliation

A/R Reconciliation

A/P Reconciliation

Ireland Bookkeeping and VAT Returns

How We Operate

Accounting Services

Process Flow

1. What is required from you?

- Sales / Purchase invoices

- Capex invoices

- Bank / Credit card statements

- Supplier statements

- Payroll reports

- Property completion statements

- Cash book

- Stripe/Paypal/ Amazon/ Shopify statements

- Loan schedule and statement

- Hire Purchase agreements

- Lease agreements

- Expense claim sheet

- Rental income statement/ledgers

2. Scope of Work

VAT:

- Selecting the most appropriate scheme for your client’s business.

- Preparing VAT returns and detailed reports.

- Submitting VAT returns.

- Utilizing an appropriate VAT method (Cash / Accrual).

-

Bookkeeping:

- Processing of invoices and bills.

- Processing of expenses.

- Bank analysis and matching process.

- Reconciliation of bank accounts, credit cards, e-commerce etc.

- Examination of aged debtors and creditors records.

- Payroll recording and reconciliation, CIS reconciliation.

- Clearing the backlog.

- Review of bookkeeping.

- Migration to cloud-based software.

3. What we will provide?

VAT:

- VAT Summary

- VAT Return

- VAT Detailed Report

Bookkeeping:

- Monthly / Quarterly trial balance

- Monthly / Quarterly P&L and Balance Sheet

- Nominal ledger

- Aged debtors report and creditors report

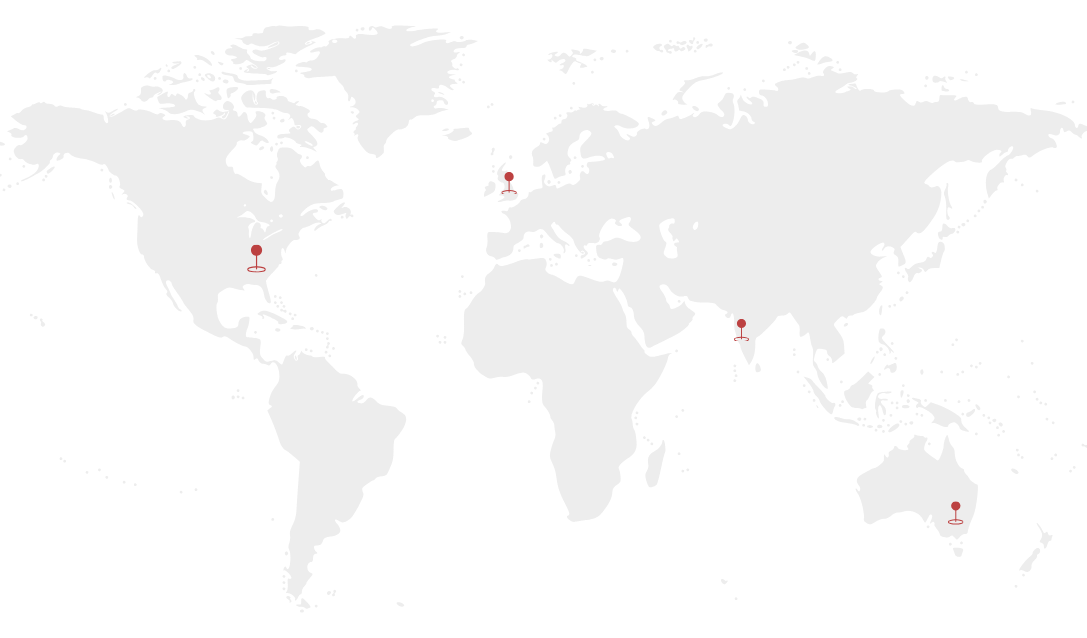

We use the same Software as you