Tax Preparation

What sets Aurnex’s Tax Preparation Services Apart?

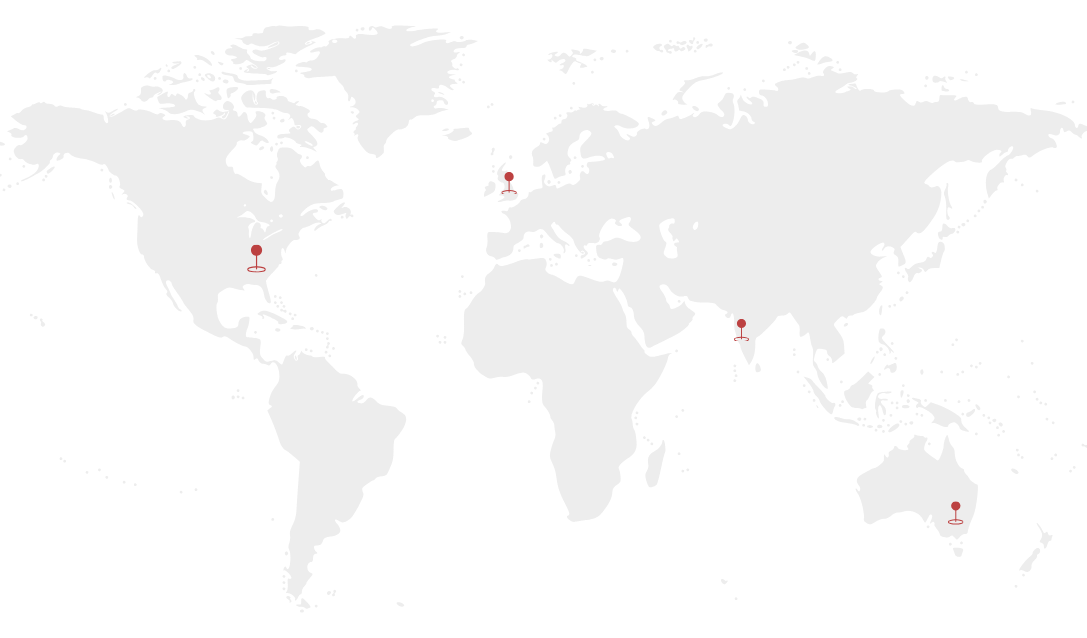

Aurnex simplifies this process by managing both your self assessment tax returns (SATR) and corporate tax reporting (CTR) functions, ensuring compliance with local tax regulations and deadlines, every time. Our team holds extensive experience in seamlessly facilitating Tax Preparation Services.

Why Choose Aurnex’s Tax Preparation Services?

By outsourcing to Aurnex, you can eliminate the hassle and complexities associated with taxation, allowing us to handle it on your behalf. Moreover, procedural delays in filings can expose you to interest and penalties. At Aurnex, we alleviate these concerns by meticulously handling all aspects of tax preparation, ensuring accuracy and timeliness.

Have Questions?- Check our FAQs here.

Sub

Services

Process

flow

- Last year’s tax computation and SA100/ SA800 / CT600 Returns

- Dividend details

- Current year documents and files

- HMRC filing credentials

Self-Assessment Tax Returns:

- Self-assessment for individuals and partnerships.

- Verifying each category of income and comparing it with last year.

- Preparing and generating tax computation, schedules & SA100 tax returns for individuals.

- Confirming and informing clients about payments on account (POA) before the deadline.

- Capital Gain Tax computation.

- Review and file online with HMRC.

- Tax planning advise for next year.

Corporate Tax Preparation:

- Calculating profit chargeable to corporation tax.

- Calculating capital allowance and balancing charge.

- Implementation of losses brought forward and carry back the losses.

- Claiming Group Relief.

- Amendments of filed corporation tax returns.

- Preparing CT600, CT600A in case of S455 Tax.

Self-Assessment Tax Returns:

- Tax computation report

- SA800

- SA100

- Tax summary and workings in Excel

Corporate Tax Preparation:

- Tax computation report

- CT600 & Supplementary Pages (CT600A, CT600C, CT600L etc).