The world of corporate finance does not allow for anything less than perfect accuracy. This accuracy comes from a crucial process called Account Reconciliation. Although this may sound like a boring administrative function, it is the single most powerful weapon an organization wields to prevent fraud, financial mismanagement, and regulatory non-compliance.

Regardless of whether you run a small business or are a finance professional at a Fortune 500 company, mastering the reconciliation process is the secret to a seamless month-end close and bulletproof audit trail.

What is Account Reconciliation?

Account reconciliation is the official procedure of comparing two sets of financial records, usually one internal general ledger and one external source such as a bank statement and confirming that they match.

A reconciliation is when the two balances match — then the account has been “reconciled.” Discrepancies between the two should be, investigated, explained, and corrected if there is a difference. This process verifies that all dollars out of the business are accounted for on a going out and on a coming in and the reported health of the business is an accurate reflection of reality.

The Standard Reconciliation Process

Every minute carries weight that a finance team cannot afford to miss — meaning a high-performing function will maintain a six-step workflow to ensure no detail goes unattended.

Data Collection :It starts with acquiring the source of truth. This can involve internal general ledger reports and sub-ledgers, or external documents, such as bank statements, credit card reports or vendor invoices.

Transaction Matching :Whether through manual spreadsheets or automated accounting software, accountants then match internal entries with external records line by line.

Identifying Discrepancies :In matching process, some items may not be matched together. There are three main categories of these ”exceptions:”

Example Timing differences:Deposits In transit or Outstanding Checks

Data entry mistakes or transposed numbers → → → Errors

Omissions: Bank service charges or interest you have not yet recorded

Investigation and Adjustment :Their job, then, is to find the “why” between the discrepancy. Once they pinpoint the issue, they make correcting journal entries to adjust the internal books to show what the actual cash position is.

Management Review :To avoid the fox guarding the henhouse, a second party (typically a controller or manager) must review the reconciliation and approve any adjustments.

Final Archiving :It saves the audit saved along documented supporting evidence This becomes the tape measure for external auditors at year-end testing.

Account Reconciliation Examples

Data Collection: Obtaining Internal General Ledger Reports and External Bank Statements for Comparison Prep

Timing Difference: A check (or other withdrawal) recorded in the company’s books but not yet cleared by the bank.

Accounts Payable: Reviewing a vendor’s statement against internal records of what the company owes to never accidentally pay too much to the company.

Inventory: Conducting a physical count of inventory in buildings to ensure the numbers add up with the accounting software.

Segregation of Duties —Making sure that the person writing checks is different than the one performing the reconciliation to avoid fraud.

Unacknowledged Discrepancies:Bookkeeping a sparse variance under ”Miscellaneous Expense,” but marking major differences for an internal audit

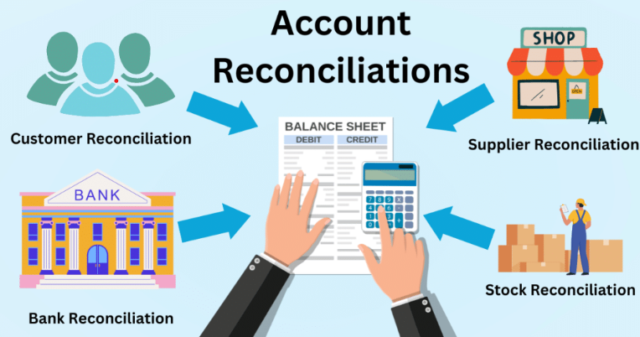

Types of Account Reconciliation

All accounts are not created equal. Financial teams then focus on a few targeted types, depending on the business area.

- Bank reconciliation: The most common type, which involves reconciling the company cash account to the bank statements.

- Accounts Payable (AP): Cross-referencing vendor statements against internal “money owed” records to avoid paying more than what is owed.

- Accounts Receivable (AR) — Apply customer payments towards the intended invoices to keep cash flowing.

- Intercompany Reconciliation: This is an intricate procedure for big corporations where transactions between various branches or subsidiaries need a zero net.

- Product Inventory Reconciliation: This involves comparing the physical count of goods in the same warehouse with the numbers reflected in the accounting software.

The Benefits: Beyond Simple Math

We all have background process that we run through every year (hundreds of hours!) why bother? There are many advantages to meticulous accounting:

- Fraud Reduction: The quickest way to identify unauthorized withdrawals, “ghost” vendors, or employee theft is through reconciliation.

- Meeting Regulatory Requirements: In the case of public companies there is a legal requirement for reconciliation in frameworks like Sarbanes-Oxley (SOX).

- Cash-knowledge: if you do not know how much cash you have, you cannot make strategic investments.

- Accelerated Month-End Close: If you are reconciling on a more frequent basis (daily or weekly) then the final ‘close’ at the end of the month is only a minor chore rather than a weeklong marathon.

The Shift to Automation

The days of “Manual Excel” are over: Modern finance is about AI-driven automation That is, accounting software can automate 90% of this transaction matching process, so accountants do not spend their time ticking boxes but instead investigating anomalies. This minimizes human error and enables real-time insights into financial data.