Table of Content

1. The Evolution of Accounting Offshoring

2. Top 7 Offshoring Destinations

3. Key Considerations When Choosing an Offshoring Destination

5. Frequently Asked Questions About Accounting Offshoring

As the global business landscape continues to evolve, accounting firms and businesses are increasingly turning to offshoring as a strategic solution for maintaining competitiveness and efficiency. In 2025, several countries have emerged as leading destinations for accounting offshoring, each offering unique advantages and specialized expertise.

The Evolution of Accounting Offshoring

The accounting industry has transformed significantly with technological advancements and changing business needs. Modern offshoring isn’t just about cost reduction – it’s about accessing global talent, leveraging time zone differences, and maintaining quality while scaling operations.

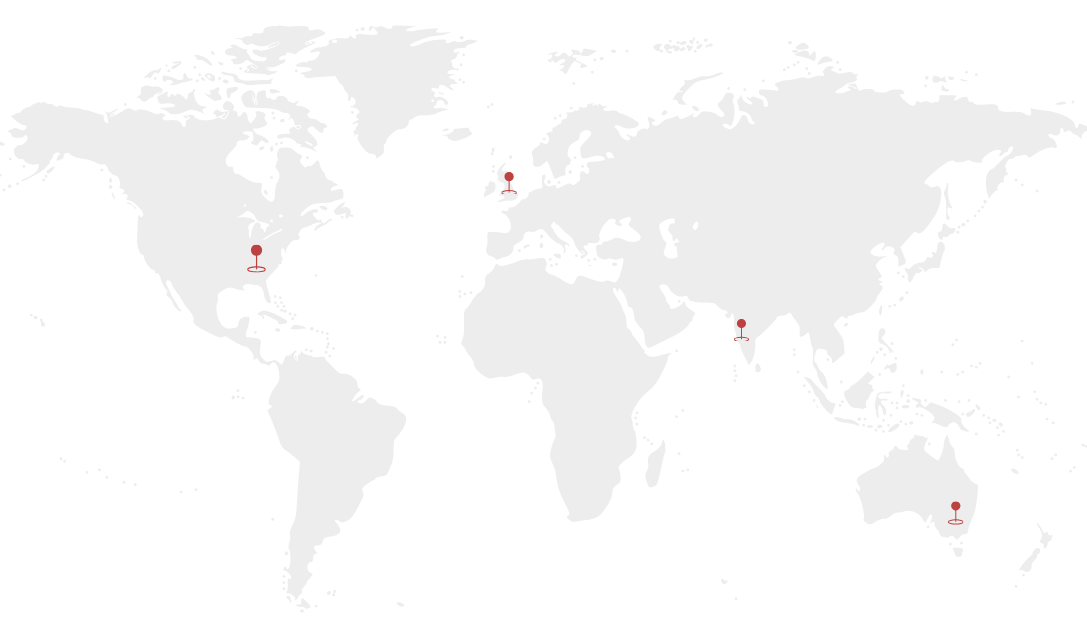

Top 7 Offshoring Destinations

1. India: The Premier Accounting Offshoring Hub

India maintains its position as the leading destination for accounting offshoring in 2025, offering:

– Extensive pool of qualified accounting professionals

– Strong expertise in US GAAP and IFRS

– Advanced technological infrastructure

– Significant cost advantages

– Excellent English proficiency

– 24/7 operational capability

2. Philippines: Excellence in Customer-Centric Services

The Philippines has established itself as a major player in accounting offshoring by offering:

– Strong cultural alignment with Western practices

– High-quality English communication

– Specialized BPO zones

– Government support for outsourcing

– Focus on customer service

– Expertise in US accounting standards

3. Vietnam: The Emerging Powerhouse

Vietnam’s growing prominence in accounting offshoring is attributed to:

– Competitive cost structure

– Rapidly developing infrastructure

– Strong technical education system

– Government support for IT development

– Growing English proficiency

– Focus on technological innovation

4. Poland: European Excellence in Accounting

Poland offers unique advantages for firms with European operations:

– Strategic European time zone

– High-level accounting expertise

– Strong regulatory knowledge

– Advanced technological infrastructure

– Multi-lingual workforce

– EU compliance expertise

5. South Africa: Strategic Time Zone Advantage

South Africa has become an attractive destination due to:

– Compatible time zones with Europe

– English-speaking workforce

– Modern infrastructure

– Cost-effective services

– Strong financial sector

– Quality education system

6. Malaysia: Southeast Asian Hub of Excellence

Malaysia offers distinctive benefits including:

– Multi-lingual workforce

– Strong international business culture

– Modern technology infrastructure

– High educational standards

– Strategic location

– Robust regulatory framework

7. Mexico: Nearshore Advantage for US Firms

Mexico’s proximity to the US provides unique benefits:

– Similar time zones

– Cultural alignment

– NAFTA advantages

– Bilingual workforce

– Easy travel access

– Growing technology sector

Key Considerations When Choosing an Offshoring Destination

Infrastructure and Technology

– Internet connectivity reliability

– Technology adoption rates

– Data security measures

– Modern office facilities

– Digital infrastructure

– Cloud computing capabilities

Workforce Quality

– Educational standards

– Professional certifications

– Industry experience

– Language proficiency

– Cultural compatibility

– Work ethic

Economic and Political Factors

– Economic stability

– Political environment

– Currency fluctuations

– Legal framework

– Intellectual property protection

– Business-friendly policies

Cost Considerations

– Labor costs

– Infrastructure expenses

– Training requirements

– Time zone impact

– Travel costs

– Communication expenses

Future Trends in Accounting Offshoring

The landscape of accounting offshoring continues to evolve with:

– Increased automation integration

– Enhanced data security measures

– Advanced collaboration tools

– Real-time reporting capabilities

– AI-powered analytics

– Blockchain implementation

Conclusion

While these seven countries offer compelling advantages for accounting offshoring, businesses must carefully evaluate their specific needs and circumstances when selecting an offshore destination. The right choice depends on various factors, including service requirements, budget constraints, time zone preferences, and quality expectations.

In this evolving landscape, partnering with experienced service providers becomes crucial for success. Aurnex USA stands out as a premier accounting outsourcing provider, offering the perfect blend of global expertise and local understanding. With state-of-the-art technology infrastructure, highly qualified professionals, and a proven track record of serving diverse industries, Aurnex USA provides comprehensive accounting solutions tailored to your specific needs. Their service portfolio includes everything from basic bookkeeping to complex financial analysis, ensuring that businesses can focus on growth while their accounting operations are managed with precision and excellence. Contact Aurnex USA today to explore how their offshore accounting solutions can transform your business operations and drive sustainable growth.

Frequently Asked Questions

Accounting offshoring can benefit businesses of various sizes. Small firms often use offshoring for basic bookkeeping and tax preparation, while larger organizations might offshore more complex functions like financial analysis and reporting. The key is finding the right scale and scope for your specific needs.

reputable offshoring partners implement multiple security measures:

– End-to-end encryption

– Secure data centers

– Regular security audits

– Strict access controls

– Compliance with international standards

– Regular backup procedures

Cost savings typically range from 40% to 60% compared to in-house operations, depending on:

– Service complexity

– Location choice

– Volume of work

– Contract duration

– Service level requirements

Time zone differences can actually be advantageous, offering:

– 24/7 operational capability

– Overnight processing

– Extended business hours

– Faster turnaround times

Key qualifications include:

– Relevant accounting certifications

– Experience with international accounting standards

– Proficiency in accounting software

– Strong English communication skills

– Understanding of local tax laws

– Industry-specific experience

The transition typically takes 4-8 weeks, depending on:

– Scope of services

– Process complexity

– Data migration requirements

– Training needs

– Customization requirements

Yes, established offshore providers maintain teams trained in various countries’ accounting standards and regulations. They regularly update their knowledge to ensure compliance with local requirements.

Essential technology requirements include:

– Reliable internet connectivity

– Secure communication channels

– Cloud-based accounting software

– Document sharing platforms

– Project management tools

– Video conferencing capabilities